Your income would need to be low enough to qualify for a Chapter 7 bankruptcy yet high enough to demonstrate you can afford a Chapter 13 plan. What Bankruptcy Can Do.

Artikel ini diterjemah dari Income tax offences fines and penalties in Malaysia oleh Rebecca Hani Romeli.

. While its possible after taking into account the debts wiped out in Chapter 7 it would be wise to consult with a local bankruptcy lawyer before adopting Chapter 20 bankruptcy into your debt relief. Cara provides Diana with a car fringe benefit because Diana uses the car for private purposes. Kalau la ade tahun-tahun lepas korang lupa nk declare tulis la kat sini.

Bahgian ni sebenarnya takde ape-ape kaitan dalam borang e-BE nnt sebab ni cuma nak tunjukkan dalam sepanjang tahun korang kerja. We would like to show you a description here but the site wont allow us. Youll choose the chapter thats right for you.

Contohnya kalau lepas kira-kira jumlah korang kena bayar cukai ialah RM500 tapi sebab kurang declare sampai RM1500 kena bayar tau kalau penalti 300. What Happens When You File for Bankruptcy. Anda mungkin terlupa buat e-Filing cukai pendapatan atau mengisytiharkan jumlah pendapatan yang lebih rendah berbanding jumlah yang anda perolehi.

The other employees use of the car is only for business purposes and Cara provides no car fringe benefits or exempt car benefits for these other employees. Ikuti kami di Telegram untuk tip dan info terkini. Semua ni termaktub dalam Akta Cukai Pendapatan 1967 Failure without reasonable excuse to furnish an Income Tax Return Form.

Bankruptcy allows people struggling with debt to wipe out certain obligations and get a fresh start. The two primary bankruptcy types filedChapter 7 and Chapter 13 bankruptcyeach offers different benefits and in some cases treat debt and property differently. Anda pernah tak rasa macam tak nak bayar cukai.

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

Programming Example Tax Computation

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

3 How Do I Complete And E File The Corporate Income Tax Returns Form C S C Youtube

How To File Your Taxes If You Changed Or Lost Your Job Last Year

Discover Cara Claim Income Tax S Popular Videos Tiktok

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

.png?sfvrsn=1cb3b992_3)

Iras Individuals Required To File Tax

![]()

Monopoly Web Edition Monopoly Lovers Social Media

Rwanda Revenue Authority On Twitter Dore Uko Imenyekanisha Rya Zeru Neya Ku Musoro Ku Nyungu Rikorwa Https T Co Fzulgge8yr Twitter

Individual Income Tax In Malaysia For Expatriates

What Are Retained Earnings Guide Formula And Examples

How To File Your Taxes If You Changed Or Lost Your Job Last Year

How To File Your Taxes If You Changed Or Lost Your Job Last Year

Iras Individuals Required To File Tax

How To File Your Taxes If You Changed Or Lost Your Job Last Year

Iras Individuals Required To File Tax

-for-employment-income.png?sfvrsn=a8f5e363_1)

Iras Individuals Required To File Tax

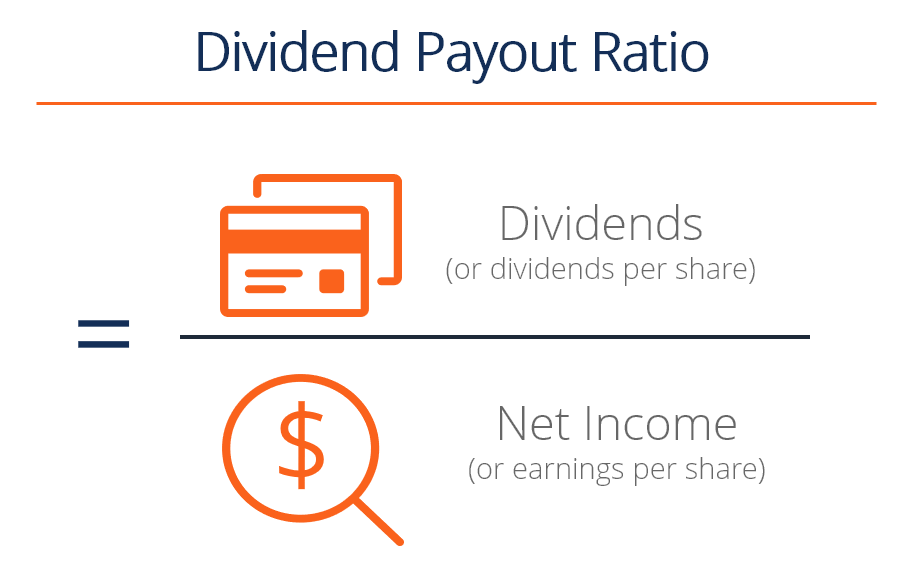

Dividend Payout Ratio Formula Guide What You Need To Know